Digital Payment

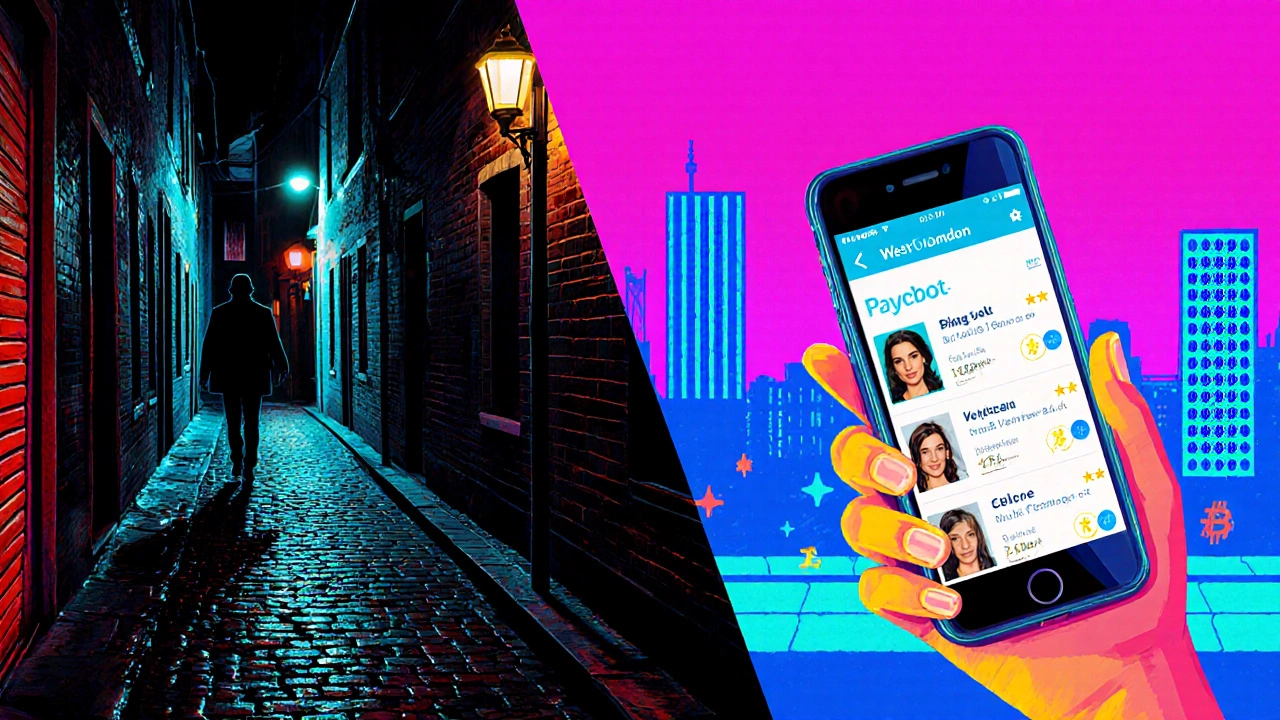

When diving into digital payment, any electronic method used to transfer money instantly, whether online or in‑person. Also known as e‑payment, it covers everything from contactless cards to app‑based wallets. The rise of payment gateway, the tech bridge that authorizes and processes online transactions and mobile wallet, software on smartphones that stores card details for tap‑and‑go purchases has reshaped how people pay for clubs, rides, and even private bookings. Digital payment offers speed, traceability, and convenience, but it also brings security challenges that require fraud detection, encryption, and compliance with local finance rules. In the bustling London scene, a quick tap at a bar or a discreet crypto transfer can mean the difference between a smooth night out and a hiccup at the door.

Key Benefits and Considerations

One major benefit is transaction speed: digital payment enables instant clearance, so you never wait for a check to clear before heading back to the dance floor. Contactless cards encompass NFC technology, letting you wave your wrist for a drink without digging for cash. Mobile wallets require robust security layers—biometrics, tokenization, and real‑time monitoring—to keep hackers at bay. Meanwhile, cryptocurrency influences digital payment adoption by offering an alternative when traditional banks impose limits or fees. For nightlife venues, integrating a payment gateway means smoother POS systems, lower charge‑back rates, and better analytics on peak spending times. Fraud prevention tools, such as AI‑driven risk scoring, add another safety net, especially when high‑roller bookings involve larger sums.

Regulatory compliance shapes how digital payment providers operate in the UK, mandating strong customer authentication and data protection under GDPR. Understanding these rules helps both consumers and service providers avoid penalties and build trust. Looking ahead, emerging trends like biometric wallets and instant crypto settlements promise even tighter integration between payment tech and everyday experiences. Whether you’re a club‑owner optimizing checkout flow or a guest wanting hassle‑free entry, mastering the mix of contactless cards, mobile wallets, payment gateways, and crypto will keep your night moving smoothly. Below you’ll find a collection of articles that dive deeper into each of these tools, offer practical tips for safe spending, and showcase real‑world examples from London’s vibrant night scene.

- Oct 13, 2025

- Posted by Aurelia St. Clair

Tech's Big Boost for West London Escorts: What You Need to Know

Tech has turned West London escort services into a fast, safe, and customizable experience, with clear pricing, instant bookings, and modern payment options.

- Oct 8, 2025

- Posted by Astrid Kensington

Tech-Driven VIP Escort Scene in London: How Apps, AI & VR Are Changing the Game

Explore how AI, VR, and secure apps are reshaping London's VIP escort scene, with pricing, safety tips, and the emotions you'll experience.